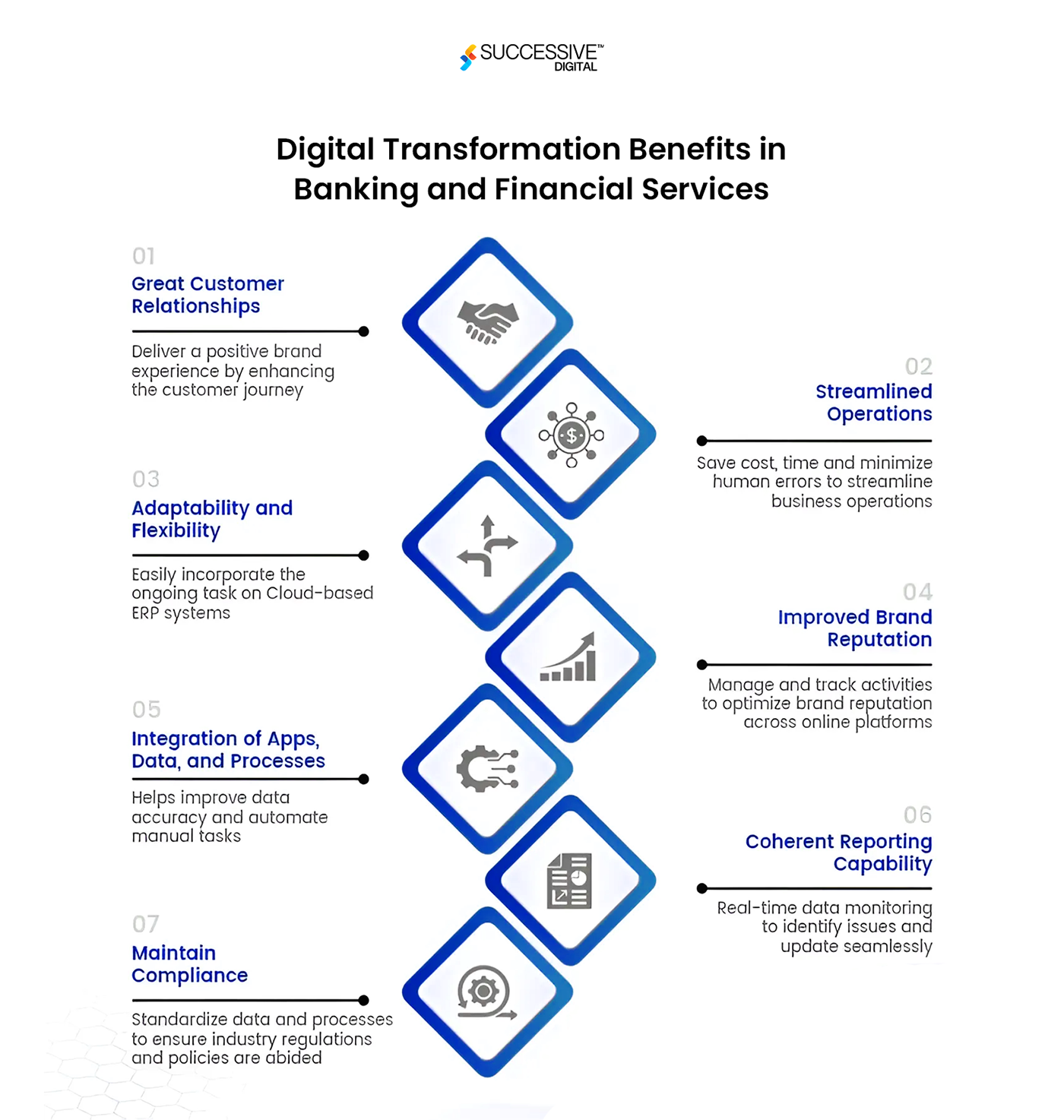

The financial and technological convergence in the world today has changed people’s perception of access to interact with financial services. Often called Fintech, this revolution is a shift from traditional business to digital first approach that prioritizes customers, innovation and accessibility. Digital transformation in banking implies financial freedom, eliminating barriers allowing everybody regardless of where they reside or their economic background be empowered. Traditional financial hassles like waiting in lines, filling out countless forms, and dealing with complex bureaucracy are a thing of the past. Digital transformation in banking industry utilizes advanced tools like mobile apps and online platforms to make financial transactions quick and effortless. This transformation has not only enhanced the customer experience but also sparked a surge of innovation and competitiveness in the finance industry.

The global fintech industry continues to evolve through technology as well as the rise of artificial intelligence (A)), blockchain and mobile finance. The impact of modern financial services on global economies with surge in technology like data analysis and fintech accessibility remains significant. This blog will explore recent trends, developments in technology as well as changes in the global outlook towards banking of today and tomorrow with fintech innovations.

The Evolution of Customer Experience in Fintech

In the past, finance involved complex forms, paperwork, and strict rules. However, the arrival of fintech has shifted the focus to customers and simplified financial interactions. Digital technologies are now revolutionizing the way people manage their money, providing convenience, accessibility, and empowerment like never before.

Fintech’s main goal is to make financial services available to more people. It does this by breaking down barriers. Fintech makes finance easier to use through apps for mobile banking, online platforms for investing, and networks for peer-to-peer lending. Because of this, more people can use the financial system, which makes it more balanced and gives people more control over their money. All this has enabled better customer experience for banking sector and gained competitive advantage over those still struggling with traditional financial service approach.

Digital advancements in finance have made complex financial procedures more interactive. Instant payments, digital wallets, and investment tools are becoming more widely used. These advancements eliminate inefficiencies, reduce interruptions, and simplify processes for customers while also boosting the productivity of bank finance departments. This combination enhances customer satisfaction and streamlines overall business operations.

Emerging Trends in Fintech Innovation

Open Banking:

Open banking aims to promote secure data exchange between banks and other organizations using APIs. This collaboration fosters innovation, enabling fintech companies to create tailored products and services.

Artificial Intelligence (AI) and Machine Learning (ML):

- Tailored recommendations

- AI algorithms suggest customized financial products

- Fraud detection

- ML algorithms analyse data to flag suspicious transactions

- Improved customer support

- Chatbots use natural language processing to provide real-time assistance.

- Enhanced decision-making

- Predictive analytics models use data to improve credit and loan approvals.

Insurtech Innovation:

The fusion of insurance and digital (Insurtech) is fuelling progress within the area. Emerging agencies in this industry leverage contemporary technologies consisting of data analytics, artificial intelligence, and Internet of Things (IoT) to offer tailored insurance solutions.

They also simplify the technique of dealing with claims and enhance the assessment of dangers. This shift no longer most effective improves the accessibility and affordability of coverage however additionally tailors it to personal necessities, driving to a groundbreaking transformation in financial sector.

Tech Innovations: Digital Transformation’s Influence on Fintech

-

Embedded Finance:

This technology in fintech seamlessly combines financial services such as transactions, advances, and coverage directly into non-monetary apps and experiences. This streamlines for individuals to reach these services directly where they are, like during purchasing online, utilizing ride-sharing apps, or interacting on social media. Through providing tailored banking resolutions, organizations can retain their customers, keep them involved and loyal for long term success.

-

Decentralized Finance (DeFi):

DeFi (decentralized finance) platforms use blockchain technology to remove the requirement for conventional financial mediators such as banks and companies. They offer full financial services, such as loans, business administration, and asset management. These advantages of digital change in banking are available to people with limited internet access as well, empowering them to oversee their finances autonomously.

-

RegTech and Compliance Solutions:

RegTech, or Rule Technology, includes inventive solutions crafted to streamline regulation conformity processes within the financial industry. These technologies utilize sophisticated algorithms, artificial intelligence, and blockchain to automate conformity tasks, monitor transactions for questionable activities, and ensure adherence to regulation standards. By substituting manual processes with automated systems, RegTech solutions improve efficiency, decrease operational costs, and alleviate conformity risks for financial institutions.

In addition, they enable immediate monitoring and reporting, facilitating proactive conformity management. RegTech is essential in assisting organizations navigate the intricate regulatory landscape while remaining competitive and conforming in an evolving financial environment.

-

Quantum Computing:

Despite its early stages, quantum computing holds the potential to transform financial technology. By quickly resolving complex mathematical equations that current computers find challenging, it enables:

- Speedy financial algorithm trading

- Enhanced risk analysis

- Optimized financial operations

Examples of How Fintech Services are Delivered and Consumed

Plaid:

The Plaid API empowers programmers to create applications that can securely capture banking information. This makes it easy to create new and sophisticated financial planning apps, personal financial planning tools and loan networks.

Square:

Square first offered digital services for companies to manage payments, however now additionally offers Square Cash, a manner for individuals to send money to every other, and Square Capital, which presents loans to small businesses. These services demonstrate how generation can help business owners and streamline the process for individuals and groups to manipulate their budget.

Coinbase:

Coinbase is a mobile utility that provides the possibility to buy and alternate various digital assets, including bitcoin, ethereum, litecoin, and severa others. Users have the choice to utilize Coinbase for changing one cryptocurrency for some other, as well as for moving digital belongings to and from other people. Moreover, Coinbase gives actual-time updates on cryptocurrency costs and marketplace tendencies, lets in you to monitor your funding portfolio, and presents the state-of-the-art information articles related to the virtual currency enterprise.

Embracing the Future of Fintech Innovations

The fusion of banking and technology, known as the fintech revolution, has triggered massive change and progress. This digital shift has a significant impact on the financial sector, enabling inclusiveness, effectiveness, and empowerment.

To make financial technology sustainable, it’s important to employ skilled professionals for banking innovation. But it’s equally important to prioritize customers by focusing on security, transparency, and trust. By tailoring services to meet user needs, promoting responsible innovation, and collaborating with reputable financial technology app developers, businesses can unleash the full potential of financial technology. This establishes a balanced and profitable system that benefits everyone involved.