In today’s world, the finance industry is at the forefront of digital transformation, propelled by the ever-expanding dominion of Financial Technology, or Fintech. As individuals increasingly turn to digital platforms for their financial needs, Fintech businesses are revolutionizing how users engage with money, offering convenient solutions catering to the cutting-edge customer’s lifestyle. At the heart of this transformation lies the improvement of smart mobile applications designed to streamline financial processes, improve accessibility, and elevate the overall customer experience.

This blog explores the core fintech app features that app developers should prioritize to stay ahead in the aggressive market. These features meet customers’ evolving expectations, leverage modern technological improvements, and deliver seamless, stable, and customized financial offerings. Traditional financial companies can forge stronger connections with their customers and ensure sustainable growth within the digital age by embracing innovation and integrating these crucial fintech app features into their app development strategies.

-

Seamless Onboarding Process

The seamless onboarding process is the gateway to a Fintech app’s ecosystem and is considered one of the significant features of mobile banking apps, serving as the critical first impact that sets the tone for the customer experience. Fintech applications can revolutionize the historically bulky account setup procedure into an effortless experience with modern technology, including biometric authentication and automation. Biometric authentication strategies, such as facial recognition or fingerprint scanning, now simplify the process of verifying users and enhance safety by presenting a handy and robust authentication mechanism.

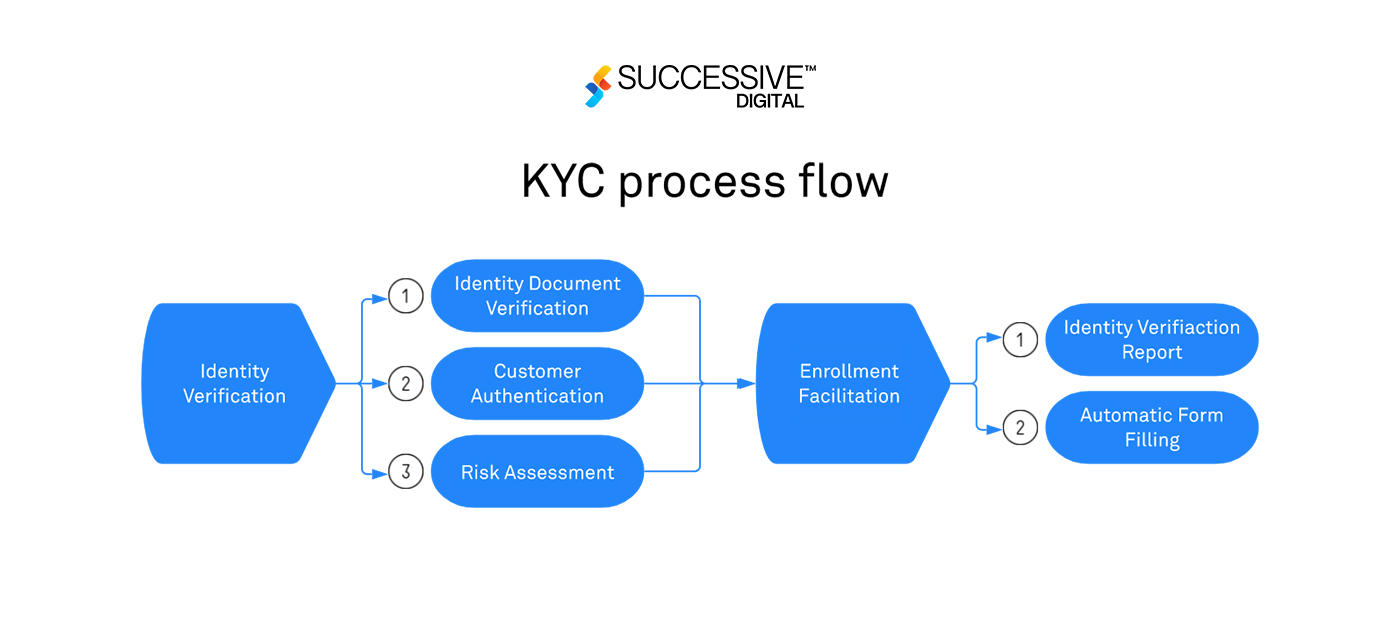

Moreover, automation plays a pivotal role in expediting account approvals and compliance methods, ensuring a rapid and trouble-free onboarding experience for users. By seamlessly integrating Know Your Customer (KYC) and Anti-Money Laundering (AML) verification processes directly into the app, Fintech businesses can decrease manual intervention and accelerate the onboarding process. This not only reassures the users about the efficiency of the process but also maintains regulatory compliance, instilling confidence in the system.

-

Personalized Financial Insights

Personalized financial insights provide users with tailored knowledge of their financial landscape, empowering them to make informed decisions aligned with their precise needs and preferences. Leveraging advanced statistics analytics and machine learning (ML) algorithms, Fintech apps examine users’ transaction history, spending patterns, and investment behaviors to offer custom-designed tips and actionable insights.

These insights go beyond typical financial recommendations, providing targeted recommendations on budget optimization, saving possibilities, investment strategies, and debt control. By presenting users with a holistic view of their financial health and capability growth opportunities, personalized insights foster an experience of possession and manipulation over their monetary future.

Moreover, as customers engage with the app and input additional information, the algorithms constantly refine their pointers, ensuring relevance and accuracy over the years. Ultimately, personalized monetary insights empower users to take proactive steps toward accomplishing their financial aspirations, riding engagement, and loyalty to the Fintech platform.

-

Enhanced Security Measures

Enhanced security features inside Fintech apps encompass a multifaceted approach to safeguarding customers’ sensitive economic information and transactions from evolving cyber threats. Utilizing superior encryption protocols such as AES (Advanced Encryption Standard) and TLS (Transport Layer Security), Fintech apps make sure that every statistic transmitted between the customer’s device and the app’s servers continues to be encrypted and protected from unauthorized get admission to of entry.

Another layer of security in Fintech apps is the implementation of multi-factor authentication (MFA) mechanisms. These mechanisms require users to confirm their identity via multiple unbiased credentials, passwords, biometric records, or one-time passcodes. Biometric authentication, a present-day generation, adds more security by using biological tendencies for private identification, facial recognition, and fingerprint scanning.

Furthermore, real-time transaction monitoring and anomaly detection algorithms constantly scrutinize private activities for suspicious behavior or unauthorized transactions, triggering immediate indicators for users and administrators. By integrating the robust safety features, Fintech apps make sure that clients can consider the platform with their monetary records, fostering a feeling of self-assurance and reliability inside the system.

-

Intuitive User Interface and Experience

An intuitive user interface (UI) and user experience (UX) lie in the middle of a Fintech app’s achievement, shaping customer experience and perceptions from the instant they launch the application. Through considerate design and user-centric ideas, Fintech apps intend to simplify complicated financial methods, making them on hand and understandable to users of all stages of information.

A well-crafted UI employs intuitive navigation systems, clear navigation paths, and constant layout factors to manage users seamlessly via the app’s capabilities and functionalities. From account control to transaction monitoring, every aspect of the interface is meticulously designed to decrease cognitive load and maximize usability.

Complementing the UI, the UX specializes in delivering a seamless and exciting journey for users, waiting for their wishes and options at every touchpoint. Interactive elements, personalized hints, and customizable settings empower users to tailor the app to their liking, improving engagement and pleasure.

-

Seamless Integration with Third-party Services

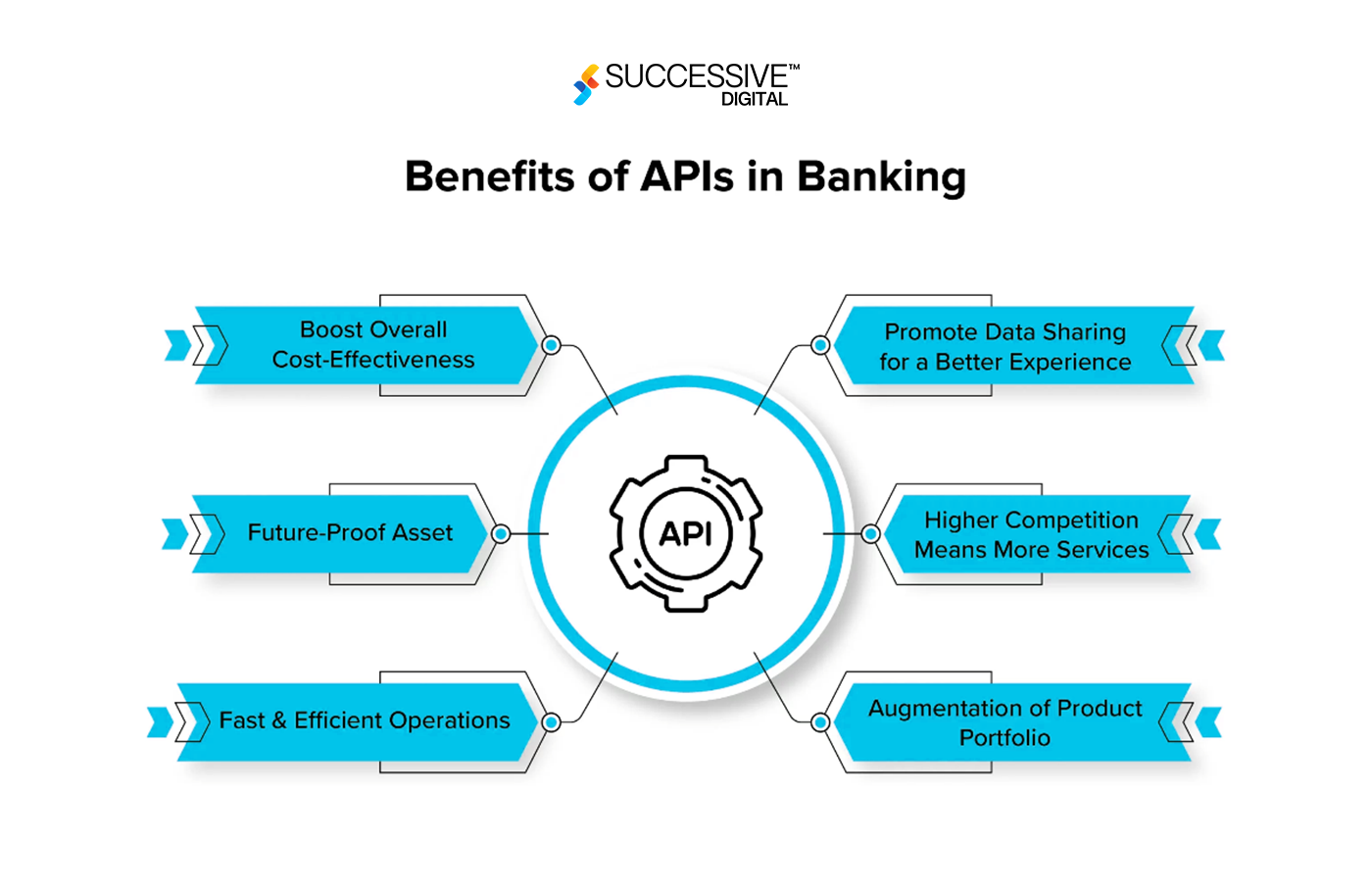

The seamless integration of third-party services is fundamental for Fintech apps aiming to deliver complete financial solutions via a unified platform. By harnessing application programming interfaces (APIs) and interoperability requirements, Fintech apps set up easy connections with a wide range of third-party offerings, enriching their functionality and enhancing consumer experience.

Through strategic collaborations with payment gateways, investment structures, and financial aggregators, Fintech apps provide users with entry to an in-depth array of financial services and products. Whether a user is involved in transferring finances between accounts, making an investment in shares, or handling coverage policies, they can seamlessly execute a myriad of services without navigating far from the app’s ecosystem.

Furthermore, seamless integration allows data sharing between different platforms, facilitating a holistic view of customers’ economic portfolios and behaviors. This permits Fintech apps to deliver customized suggestions and insights tailor-made to every consumer’s economic situation and goals.

Conclusion

The finance industry is undergoing a profound transformation fuelled by the rapid evolution of financial technology. As customers increasingly turn to digital structures for their financial desires, Fintech companies are at the leading edge of innovation, revolutionizing the way they manage and engage with financial services. Central to this change is the mobile applications developed by Fintech firms, presenting handy solutions tailor-made to present-day customer’s needs that are promising a bright future and sustained growth in this competitive ecosystem.