The intersection of finance and technology, referred to as FinTech, has become a cornerstone of digital innovation, revolutionizing conventional banking services. Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront of this evolution, transformative technologies poised to reshape the operational panorama of financial establishments, enhance customer support, and refine risk management strategies.

AI and ML have recently transcended theoretical concepts to become crucial tools within the global FinTech environment. Their ability to investigate datasets, analyze customer banking patterns, and derive actionable insights has opened new avenues for informed decision-making, personalized consumer reports, and streamlined operational workflows in the financial sector.

This blog explores the numerous benefits and compelling use instances of AI and ML in FinTech, focusing on their transformative impact on the banking industry and envisioning a future in which finance is characterized by heightened accessibility, performance, and protection.

As the need for customized banking assistance grows and regulatory challenges emerge as more problematic, the importance of AI and ML in FinTech cannot be emphasized enough. From refining funding strategies with the use of algorithmic trading to enhancing defenses against fraudulent schemes with state-of-the-art detection algorithms, the virtual revolution in banking indicates a transformative change in how economic products and services are conceptualized and delivered.

Benefits of Artificial Intelligence and Machine Learning in FinTech:

-

Enhanced Decision Making:

AI and ML algorithms empower financial companies with exceptional capabilities for more advantageous decision-making. By leveraging these technologies, institutions can process vast statistics in real-time, extracting insights and patterns that would stay hidden otherwise. This data-driven technique allows banks to make more informed and strategic decisions.

In threat evaluation, AI algorithms examine historical transaction information, market trends, and customer behavior, accurately predicting creditworthiness and defaults. Similarly, in portfolio management, ML models analyze market indicators and asset overall performance to optimize investment techniques and mitigate risks.

Moreover, AI-driven chatbots and virtual assistants offer customized recommendations and assistance to customers, improving their enjoyment and satisfaction. By automating recurring obligations and providing real-time insights, AI and ML enable economic professionals to be cognizant of various risks, ultimately using efficiency and innovation throughout the enterprise.

-

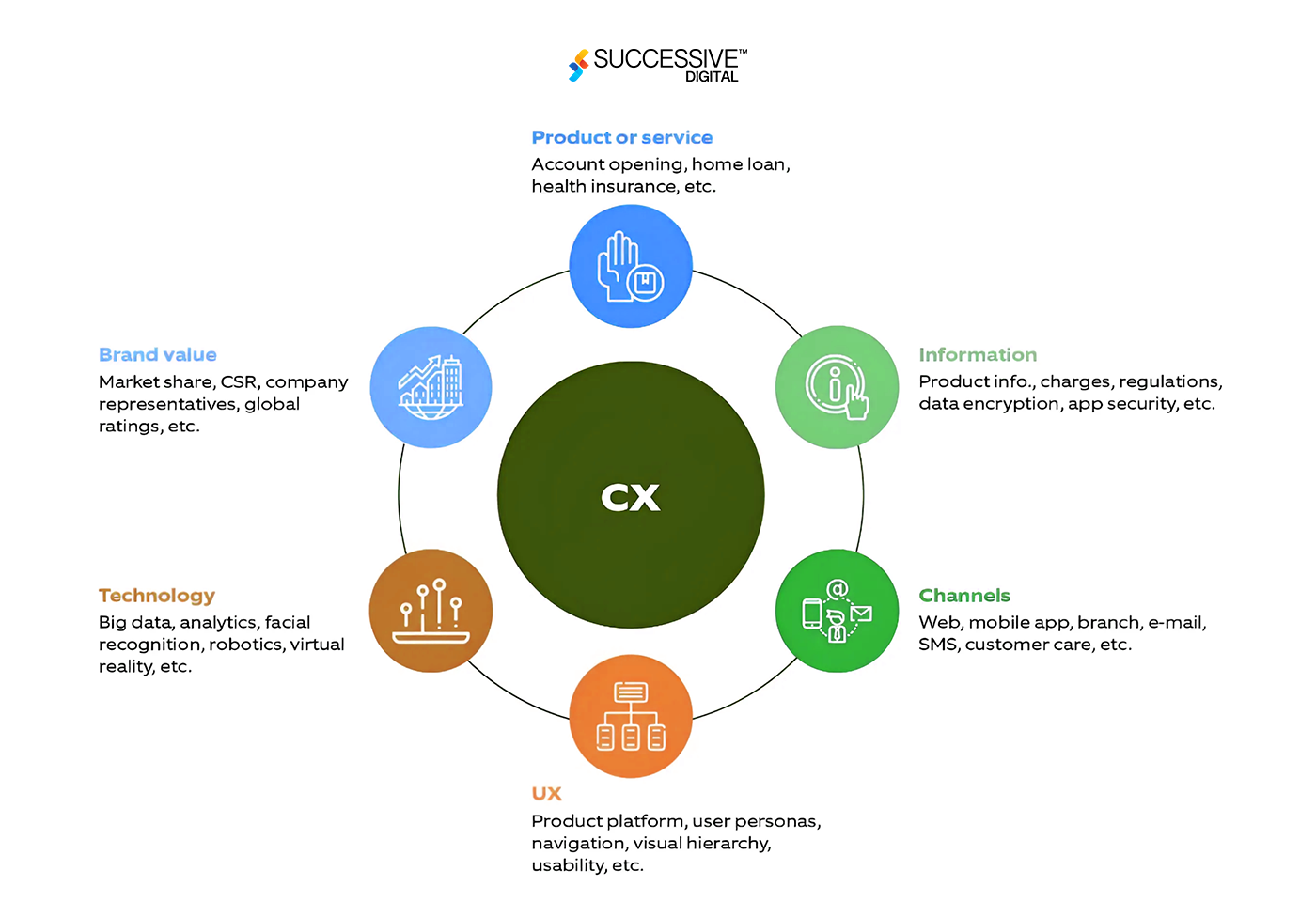

Improved Customer Experience:

In FinTech, AI and ML transform the customer experience with personalized and frictionless interactions. These technologies empower financial companies to scrutinize user facts, historical transactions, purchase trends, and individual preferences, thereby facilitating the delivery of bespoke solutions and recommendations.

Through AI-powered chatbots and virtual assistants, customers can access round-the-clock banking assistance, acquire personalized financial recommendations, and execute transactions without problems. Natural Language Processing (NLP) competencies permit these digital assistants to recognize and respond to client queries in real time, improving engagement and satisfaction.

Moreover, AI-enabled advice engines leverage predictive analytics to offer relevant product details and financial solutions primarily based on personal needs and desires. Whether optimizing funding portfolios, suggesting suitable insurance products, or facilitating mortgage programs, these personalized suggestions enhance customer trust and loyalty.

By leveraging AI and ML to supply hyper-personalised experiences, FinTech companies can deepen client relationships, power retention, and differentiate themselves in a competitive marketplace.

-

Operational Efficiency:

Operational performance lies at the core of sustainable achievement for FinTech enterprises, and AI and ML technologies have become imperative tools for reaching this goal. By automating repetitive tasks and optimizing workflows, this technology streamlines banking processes, reduces manual errors, and enhances productiveness across various sides of financial operations.

AI-powered automation structures enable the seamless execution of routine responsibilities, including document processing, data entry, and consumer inquiries, releasing human sources to the cognizance of higher-cost activities. ML algorithms enhance performance in areas like buying, selling, and portfolio management by studying market facts, identifying trends, and executing trades with precision and pace, which is not possible for human traders.

Furthermore, predictive analytics facilitated by ML algorithms allow proactive preservation of economic structures, minimizing downtime and optimizing useful resource allocation. By harnessing the power of AI and ML to power operational efficiency, FinTech businesses can decorate agility, scalability, and profitability at the same time as turning in superior services to their customers.

-

Regulatory Compliance:

AI-driven compliance structures examine tremendous volumes of transactional records in real time, flagging potential breaches and ensuring adherence to regulatory requirements. In the current regulatory landscape of the financial sector, AI and ML technologies end up integral allies in ensuring adherence to stringent compliance requirements. This technology empowers FinTech organizations to navigate complex regulatory frameworks with precision and agility.

ML algorithms constantly analyze new data inputs and regulatory updates, enabling FinTech corporations to evolve unexpectedly to evolving compliance standards. By leveraging AI and ML for regulatory compliance, economic establishments can mitigate compliance dangers, uphold regulatory integrity, and foster agreement amongst stakeholders.

Use Cases of Artificial Intelligence and Machine Learning in FinTech:

-

Algorithmic Trading:

Algorithmic buying and selling, propelled via AI and ML technology, revolutionizes the financial markets by allowing the computerized execution of trades at extraordinary speeds and efficiencies. These advanced algorithms examine sizeable datasets of marketplace developments, historical charges, and buying and selling volumes to pick out rewarding opportunities and execute trades with precision.

By leveraging machine mastering models, algorithmic buying and selling systems constantly evolve and adapt to changing market situations, optimizing buying, and selling strategies in actual time. Automating these procedures minimizes the likelihood of human errors, cuts down transaction prices, and optimizes returns for buyers. Algorithmic trading has grown to be fundamental to finance, influencing the panorama of trading techniques and investment strategies.

-

Credit Scoring and Risk Assessment:

In the space of credit score scoring and risk evaluation, AI and ML technologies redefine conventional methodologies, unlocking new dimensions of accuracy and inclusivity. By analyzing various datasets encompassing transaction histories, social media behaviors, and opportunity data assets, these algorithms provide a holistic view of an individual’s creditworthiness.

ML algorithms leverage predictive analytics to evaluate risks more comprehensively, facilitating fairer lending choices and increasing access to credit for underserved populations. Moreover, AI-driven credit scoring structures continuously refine their algorithms based totally on new statistical inputs, making sure they are adaptable to evolving financial landscapes and regulatory requirements.

-

Fraud Detection and Prevention:

Fraud detection and prevention, powered via AI and ML, represent a significant protection mechanism against evolving economic crimes. Digital transformation in banking has given rise to the adoption of such technology in financial services that analyze large streams of transactional records in real-time, using state-of-the-art algorithms to stumble on anomalies and flag suspicious spots with precision.

By leveraging ML and smart algorithms, fraud detection structures constantly analyze new facts and inputs, adapting their detection skills to rising threats. Behavioral analytics and sample reputation algorithms permit the early identity of fraudulent patterns, allowing economic establishments to take proactive measures to mitigate risks and shield assets. AI-powered fraud detection systems play a vital role in maintaining belief and integrity in the global financial landscape.

The infusion of AI and ML in FinTech ecosystems has ignited a profound transformation inside the banking industry, fuelling digital transformation in the global financial space. Through adept utilization of data analytics, financial establishments can facilitate more advantageous decision-making, elevate operational efficacy, and provide modern-day consumer experience. From algorithmic buying and selling to credit score assessment and fraud prevention, AI and ML are reshaping all dimensions of FinTech, fundamentally altering the ways financial services are delivered.